Soon after acquiring a disbursement of money from the line of credit score you will start to receive a monthly invoice to help make repayments. According to your cycle day this may be as early as 21 days from disbursement or assuming that 51 days right after disbursement.

Look at your eligibility for a loan with Biz2credit Biz2Credit requires that the business: Was established in excess of a calendar year in the past

Income Management tipsSaving moneyHandling costs and expensesShoppingShopping rewardsFinancial healthSavings goal calculatorNet truly worth calculator

The standard SBA seven(A) is the most typical, and many functional SBA loan. That has a loan number of up to $five million plus the widest number of uses, it may possibly benefit any business that’s suitable.

You could unsubscribe from these communications at any time. For information on the way to unsubscribe, and also our privateness methods and motivation to protecting your privateness, be sure to overview our Privateness Plan.

Making use of for an SBA loan typically includes a lengthier application method than for a regular business loan. The subsequent is an index of point lenders may possibly just take into consideration:

Merchant hard cash progress: These involve borrowing a lump sum and repaying it by withholding a percentage of day by day, weekly or month-to-month revenue.

Whether you ended up aiming to increase, manage day by day operations, or Develop you a money circulation security net to manage the surprising, Kapitus will help you Construct the proper loan product or service and get funding for your personal business to fulfill your special needs.

A loan ensure is the amount the federal governing administration has agreed to pay for around the loan. It may be as higher as $three.seventy five million, and it ensures that inside the occasion of deferral, the lender will nevertheless acquire that amount from the government.

Larger Approval Prices: As a result of their simpler qualification needs and simpler software procedure, substitute funders approve financing For additional smaller and medium-dimension businesses than classic lenders.

Examining account guideBest checking accountsBest no cost examining accountsBest on see here the internet check accountsChecking account alternatives

This also cuts down administrative duties by reducing the need for shareholder conferences and votes. In addition, loans Will not involve the identical polices on investments. What kind of knowledge do I want to offer to make an application for a business loan?

When it comes to credit rating boundaries and phrases, business credit card acceptance is mostly based upon your individual credit score. A line of credit rating, Conversely, gives far more overall flexibility on acceptance quantities, generally has reduce desire rates, and may be used to tug cash into your functioning account to go over operational costs or handle seasonal revenue shortages.

At a least, you’ll need a down payment of ten% of the whole loan quantity for an SBA 504 loan. Should you’re a new business otherwise you’re funding a Exclusive use home (just like a fuel station or resort), you’ll need to provide a fifteen% deposit.

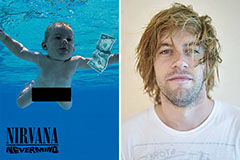

Spencer Elden Then & Now!

Spencer Elden Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!